Imagine cruising down your favorite trail, wind in your hair, and nothing but the open road ahead. Your bicycle is more than just a mode of transport; it’s your companion in adventure, your ticket to freedom.

But have you ever wondered what would happen if your trusted two-wheeler was damaged or stolen? Bicycle insurance could be the safety net you need. The cost of bicycle insurance might surprise you—affordable and tailored to your needs, it ensures peace of mind while you pedal away.

Discover how investing in bicycle insurance can save you money and protect your cherished ride. Read on to uncover the factors affecting the cost and how you can choose the best plan for your lifestyle. Your journey to secure cycling starts here.

Factors Influencing Bicycle Insurance Costs

Bicycle insurance costs depend on several factors. The bike’s value, your location, and coverage type all play a role. Riding habits and security measures also affect premiums.

Understanding the cost of bicycle insurance can be a bit like piecing together a puzzle. You might wonder why your friend’s insurance premium is lower than yours, even though both of you own similar bikes. The answer lies in the various factors that influence the cost of bicycle insurance. Each element plays a crucial role in determining how much you’ll pay. Let’s dive into these factors to help you make sense of it all. ###Type And Value Of The Bicycle

The type and value of your bicycle significantly affect insurance costs. A high-end racing bike with all the bells and whistles will cost more to insure than a simple commuter bike. Insurance companies assess the risk associated with the bike’s value and potential replacement cost. ###Usage Patterns

How often and where you use your bike impacts the premium. If you’re a daily commuter navigating city traffic, your insurance might be higher due to increased risk. On the other hand, occasional leisure riders often enjoy lower rates. It’s essential to be transparent about your biking habits when discussing insurance options. ###Location And Theft Rates

Your geographical location plays a significant role in determining insurance costs. Areas with high theft rates generally result in higher premiums. If you live in a neighborhood known for bike thefts, your insurer might charge more to cover potential losses. ###Coverage Level

What kind of coverage are you looking for? Basic coverage might only include theft protection, while comprehensive plans cover accidents and damage. More extensive coverage naturally leads to higher costs. Consider what coverage makes sense for your situation. ###Deductible Amount

The deductible is what you pay out-of-pocket before the insurance kicks in. Opting for a higher deductible can lower your premium. But, are you comfortable paying more upfront in the event of a claim? Weigh your options carefully. ###Insurance Provider

Different providers offer various pricing models and discounts. Shopping around can make a difference. Comparing offers might reveal an unexpected lower rate for the same coverage. Have you explored all available options? ###Personal Riding History

Your personal riding history can also influence costs. If you’ve had accidents or claims in the past, you might face higher premiums. Conversely, a clean riding record could earn you discounts. How does your riding history stack up? Understanding these factors can help you make informed decisions about your bicycle insurance. Have you considered all these aspects when evaluating your insurance options?

Credit: www.isinwheel.com

Comparing Insurance Providers

Understanding the cost of bicycle insurance is key for budget-conscious cyclists. Different providers offer varying premiums and coverage. Comparing options helps find the best deal.

Choosing the right bicycle insurance provider can be as vital as picking the perfect bike. Different providers offer varying coverage, premiums, and benefits. How do you ensure you’re getting the best deal? Let’s break it down by comparing some key aspects of different insurance providers.Understanding Coverage Options

Coverage can differ significantly from one provider to another. Some might focus on theft protection, while others cover accidents and damage. It’s crucial to read the fine print. For example, one provider might offer full replacement costs for a stolen bike, while another might only cover a percentage. Always ask yourself: What does my lifestyle require?Examining Premium Costs

Premium costs are another vital factor. They can vary based on the level of coverage and the value of your bike. A higher premium might seem daunting, but it could save you money in the long run if it covers more incidents. Consider if the cost is justified by the peace of mind it offers.Checking Customer Reviews

Customer reviews can provide insights into a provider’s reliability. Look for patterns in feedback. If multiple reviews mention slow claim processing or poor customer service, it might be a red flag. Would you want to deal with delays after an accident or theft?Assessing Claim Process

The ease of the claim process is crucial. Some providers might offer an online portal, while others require lengthy paperwork. I once had to file a claim after an accident; the provider made it a breeze with their efficient online system. That experience reinforced the value of a smooth process.Exploring Discounts And Special Offers

Discounts and offers can make a significant difference in your insurance costs. Some companies provide discounts for bundling policies or for safe riding records. Imagine saving 10% just because you haven’t made a claim in the last year. It’s worth asking providers about these opportunities.Evaluating Additional Benefits

Consider additional benefits that might come with your policy. Some insurance providers offer roadside assistance or worldwide coverage. These perks can be invaluable during unexpected situations. Wouldn’t it be reassuring to know you’re covered, even when cycling abroad? By asking the right questions and comparing these aspects, you can find a bicycle insurance provider that aligns with your needs and budget. Take the time to research and ensure you’re making a well-informed decision. Your bike—and your peace of mind—deserve it.Tips For Affordable Coverage

Finding affordable bicycle insurance can be challenging. You want the best coverage without breaking the bank. Here are some practical tips to consider.

Shop Around For Quotes

Get quotes from different insurance providers. Prices can vary significantly. Comparing options helps find the best deal. Never settle for the first quote.

Consider Your Coverage Needs

Think about what you need in a policy. Basic coverage might be enough. Extra features might not be necessary. Tailor the policy to your situation.

Increase Your Deductible

Raising your deductible can lower your premium. Ensure you can afford the deductible if needed. It’s a balance between risk and savings.

Bundle With Other Policies

Bundling can save you money. Check if your provider offers discounts for multiple policies. It simplifies payments and reduces costs.

Maintain A Good Riding Record

Safe riding can lead to discounts. Many insurers reward claim-free records. Being cautious pays off in the long run.

Look For Discounts

Many insurers offer discounts. Student, senior, or membership discounts might be available. Ask about any potential savings when signing up.

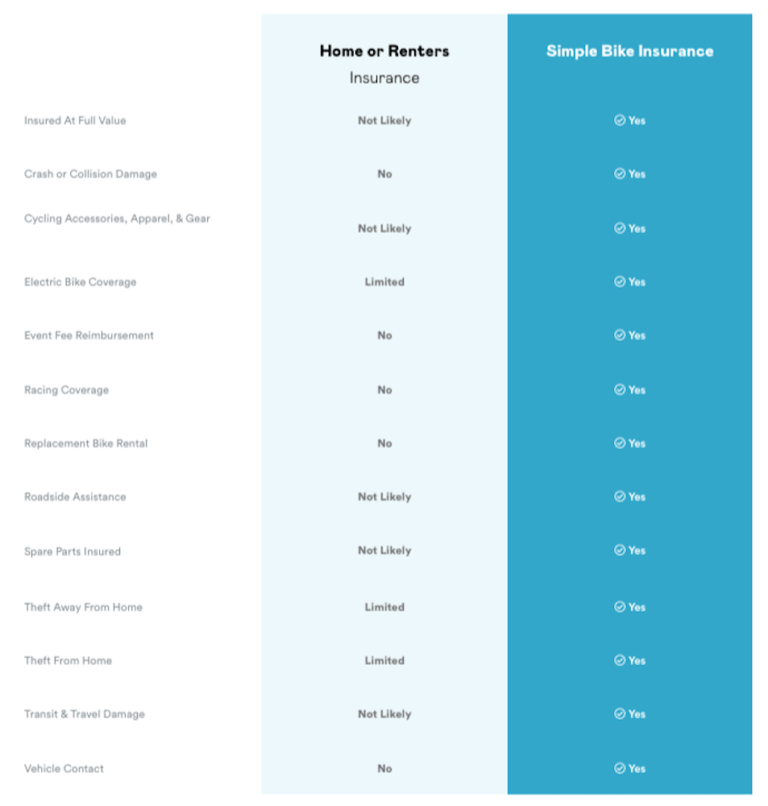

Credit: simplebikeinsurance.com

Credit: princess.com.gr

Conclusion

Understanding bicycle insurance costs helps make informed decisions. Protecting your bike doesn’t have to be expensive. Compare plans to find the best deal. Consider coverage options that fit your needs. Research can save money and stress. Choosing wisely ensures peace of mind on your rides.

Insurance offers security against theft and damage. Knowing your options means better protection for your investment. A small fee can prevent big losses. Keep cycling fun and worry-free with the right insurance. Stay safe, stay covered, and enjoy every pedal.

Your journey deserves reliable support. Explore your insurance choices today.